Merchant Payment System

Empower Businesses, Drive Banking Revenue

Merchant Payment System is a fully-configurable payment collection and reconciliation solution that enables enterprise customers of banks to deliver a seamless payment experience to end customers.

Benefits

![clip-path-group@3x[1] clip-path-group@3x[1]](https://stage.primesoft.net/wp-content/uploads/2025/09/clip-path-group@3x1-80x80.png)

For Businesses

- Faster customer onboarding process with quicker deployment Quick and easy to roll out to merchant businesses with 100% customizable payment collection templates that require no technical expertise

- More customer wins, customer stickiness A strong value proposition to win more customers with the potential to strengthen existing relationships with merchant businesses

- Increase in customer book size, potential to upsell Ability to make data-driven decisions to offer merchant businesses more banking/credit products

![business-19024562-1@3x[1] business-19024562-1@3x[1]](https://stage.primesoft.net/wp-content/uploads/2025/09/business-19024562-1@3x1-80x80.png)

For Businesses

- One dashboard view of all paymentsAbility to track and analyze payments from customer accounts through multiple payment methods, seamlessly in one place

- Increased revenue with lower operational costFaster collection of payments with minimal customer follow-ups and payment-related disputes

- Access to enhanced credit facilities from banksBetter creditworthiness with transparent transactions and an increase in current account book size

Salient Features

![payment-gateway-11526553-1@2x[1] payment-gateway-11526553-1@2x[1]](https://stage.primesoft.net/wp-content/uploads/2025/09/payment-gateway-11526553-1@2x1-50x50.png)

Multiple Payment Options

Integrate various payment modes like debit cards, credit cards, digital wallets, UPI, and internet banking (RTGS, NEFT, IMPS) into a single platform.

![time-management-18667615-1@2x[1] time-management-18667615-1@2x[1]](https://stage.primesoft.net/wp-content/uploads/2025/09/time-management-18667615-1@2x1-1-50x50.png)

High-volume Round-the-clock Processing

Highly-configurable and customizable prioritization of payment processing 24*7. High-volume transactions across all payment channels.

![gear-18393558-1@2x[1] gear-18393558-1@2x[1]](https://stage.primesoft.net/wp-content/uploads/2025/09/gear-18393558-1@2x1-50x50.png)

Secure POS Integration and Payment Processing

Incorporate POS systems to push payments to the terminal directly. Improve accounting accuracy by automating invoicing and setting-up auto-reminders, notifications, auto-refunds, and resolving duplicate payments.

Optimization of Revenue

Elimination of transaction declines with efficient routing paths. With an easy-to-configure rule engine, ensure optimum efficiency and minimize fraud losses while keeping track of critical escalations.

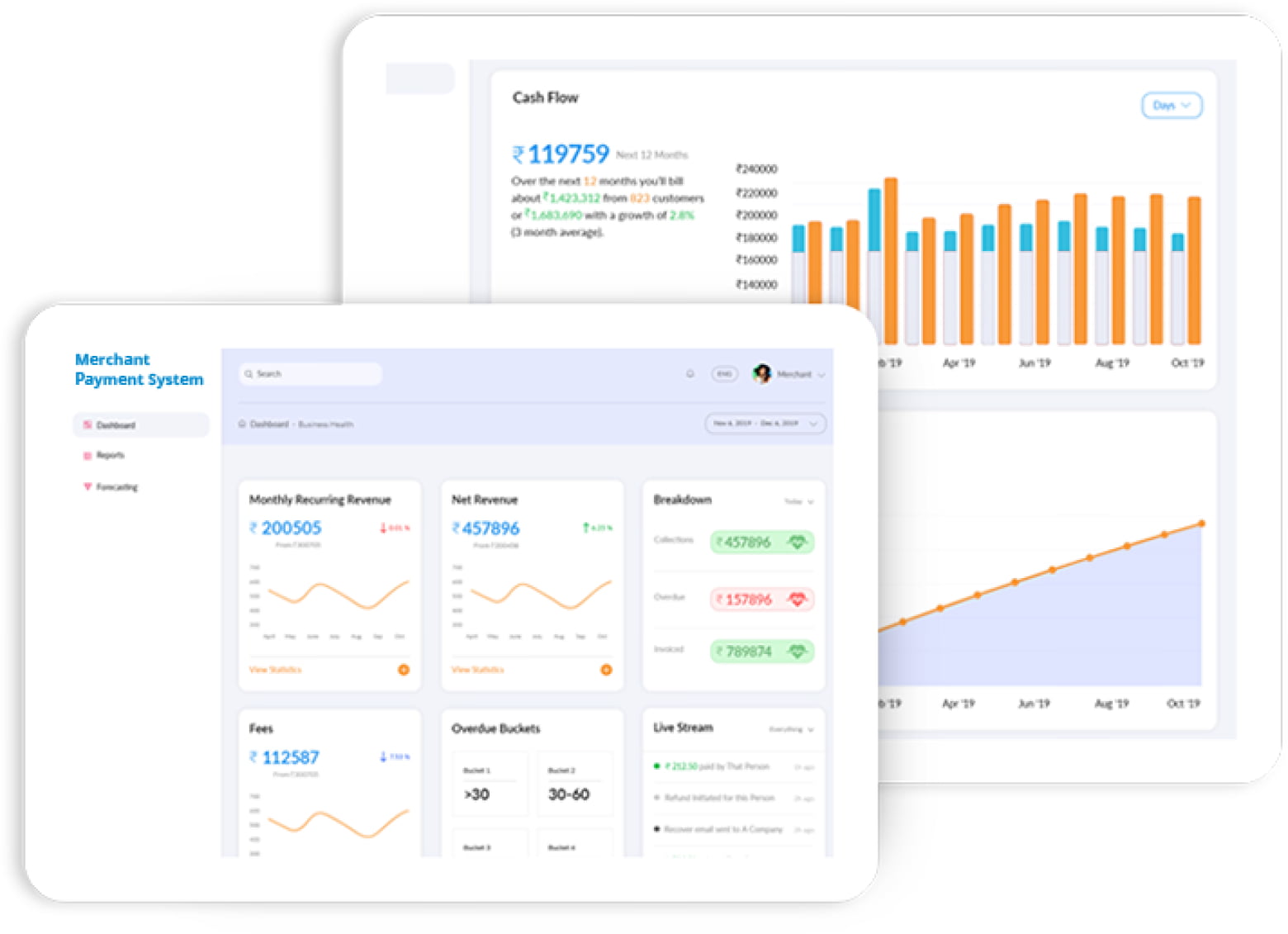

Responsive Dashboard and Reporting

All-in-one dashboard gives an analysis of payment data and business volumes. Day-to-day reporting of transactions and settlement data provides a comprehensive snapshot of performance, facilitating best business decisions.

Statutory Payments

Incorporation of federal and local body e-tax payments solutions that help banks increase their dealings with governments. API-enabled collection, easily integrable with ERP or CRM systems, ensures timely and safe payment collections.

Forex Payments

One-stop solution for handling all kinds of multi-currency payments with connectivity to online FX rate providers to achieve maximum performance, flexibility, and speed.

Visibility

Real-time payment tracking, reconciliation of payments and invoices, and end-to-end transaction references that bring greater efficiency, transparency, and cost reduction while improving customer experience.

Alert-based System

On-time alerts and notifications about every event and announcements including approved and declined transactions, special offers, promotions, etc. for quick decision support.

SOA-Based Platform

Modular and layered architecture that provides a vendor-agnostic model to enable customers to scale their business with better business agility while reducing costs by eliminating duplicate or ambiguous functions.

Proven, Extensible Data Processing Models

A single, unified data management framework – from data collection to aggregation – to give the customers a comprehensive view of multiple transactions with analytical insights.

Improved Security

Blacklist suspicious customers, and prevent fraudulent transactions with highly-effective anti-fraud tools and the ability to recognize any type of threats, attacks, and dubious activities.

How It Works

Merchant Onboarding

Banks create a merchant profile on the platform.

Users: Branch, Sales

Access Dashboard

Merchants access the portal and create multiple user accounts.

Users: Technical Managers

Collect Payments

Payment collections through a secure payee link using the easily-customizable templates.

Users: Agencies

Receive Notifications

Payee/Merchant receives receipt via SMS/Email when the merchant receives payment in his current account.

Users: Branch, Sales

Analyze Payment Data

Merchants get access to historical and current payment reports to identify and model trends/patterns.

Users: Regional Technical Managers

Types of Merchants

Schools, Colleges & Institutions

NGOs & Trusts

Hospitals

Clubs & Societies

Distributors

General Stores

Government Bodies